The equity and bond markets are at a delicate juncture. However, there could be rewarding opportunities for the discerning investor. Specific segments within each basket have the potential to deliver big gains. These segments have underperformed in recent years but could bounce back in 2020.

For instance, PSU stocks and infrastructure companies have been laggards for some time while the small-cap segment has witnessed a sharp correction in recent months. Similarly, the credit risk funds have been at the receiving end of deteriorating credit quality among corporates.

This week’s cover story looks at four such avenues. We examine what could make these high risk avenues potential winners and tell you how to make most of this opportunity. However, these avenues are inherently risky and not for the faint hearted. For instance, certain vulnerabilities in PSU and infra stocks make them fragile. Only investors who understand the risks and are comfortable with volatility should consider investing here. For these investors, the payoff could be sizeable.

1. PSU stocks may see a re-rating

Analysts have turned bullish on select PSU stocks with strong financials and dominant market share.

PSU stocks have been among the weakest performers over the past 3-5 years. The broader PSU index, comprising around 60 stocks, yielded -5.7% and -3.9% annualised returns during this period, even as the Sensex clocked 15.35% and 7.3% respectively. The economic slowdown and slow pace of disinvestment have hurt this segment. However, some reckon the aversion in a few PSU stocks is overdone.

“PSU stocks have been beaten down irrationally despite superior balance sheets, just because the government is their owner,” rued Shyam Sekhar, Chief Ideator and Founder, iThought, in a recent interaction with ETMarkets.com.

Analysts contend that if the government manages to divest in a few PSUs, these stocks may see a significant re-rating. “A successful strategic disinvestment or privatisation of a large PSU may lead to a re-rating of dominant PSUs with strategic moats and should be watched carefully,” says a report by ICICI Securities.

To be sure, the government has fallen woefully short of its disinvestment target for the current financial year. The planned strategic sales of BPCL and Container Corporation have hit roadblocks. So far in 2019-20, the government has merely raised Rs 18,094 crore out of a disinvestment target of Rs 1.05 lakh crore. However, the government intends to take its divestment programme forward, with a number of stake sales of PSUs lined up in the next fiscal.

But investors should watch out for the ongoing equity dilution in PSUs. The government has already unloaded partial stakes in PSUs through CPSE ETF offerings in the past few years. Further, the government plans to expand the ETF portfolio by including stocks of PSBs, public sector insurance firms and financial institutions. All this will increase the supply of PSU stocks, keeping prices subdued.

Fund houses have started taking positions while analysts are turning positive on select PSUs. Companies that enjoy dominant positions in their sectors, have strong balance sheets and are witnessing a turnaround in business cycle are being fancied. Neelesh Surana, CIO, Mirae Asset Mutual Fund, says, “We are positive on many PSUs, particularly those in the utility and OMCs space on account of improving earnings and attractive valuations. The space is relatively amongst the most attractive as current valuation drawdown is also exaggerated on account of government supply of stock via ETF.”

Others too are bullish on this segment, though for different reasons. Sankaran Naren, Executive Director and CIO, ICICI Prudential Mutual Fund, reckons PSU stocks appear very attractive from dividend payout perspective. “Higher dividend payouts from PSUs can be expected given the revenue shortfall faced by the government,” he points out. Several PSU stocks boast very attractive dividend yields (see table).

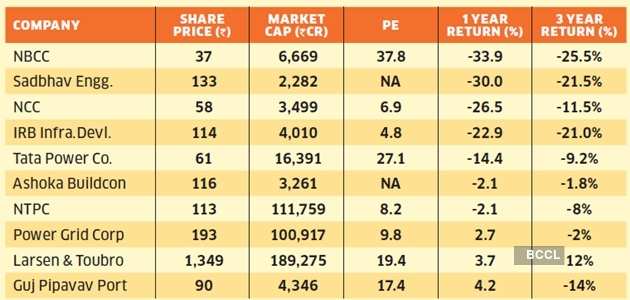

PSU stocks boasting high dividend yields

A shortfall in revenues could make the govt demand high dividends from PSUs.

Data as on 27 Jan | Source: Value Research

ICICI Securities believes PSU companies that enjoy dominance and a strategic moat in sectors such as banking, logistics, gas and defence can create value over the medium to long term. It prefers SBI, Bank of Baroda, Container Corporation, Indraprastha Gas, Petronet LNG and Bharat Electronics.

2. Govt capex could boost infra stocks

An ambitious government plan could help the infrastructure sector shake off its inertia.

Infrastructure stocks have also remained subdued over the past few years. Barring a few exceptions, project execution has been slow amid issues related to land acquisition, environmental clearances, extended monsoon and liquidity dogging the sector. There is now a buzz that the government will give another push to the sector. But should you bite?

The government recently announced an outlay of Rs 102 lakh crore over the next five years to add more muscle to India’s infrastructure. However, analysts say unavailability of funds may limit this ambitious plan. “The report includes detailed planning of projects and spending across sectors for next five years. However, it lacks details about financing of projects and nitty gritty around execution of these plans,” says Edelweiss. Centrum Broking feels the investment target is too ambitious and with states accounting for 39% of the total outlay, their ability to generate the financial resources is uncertain.

While infrastructure spending targets may be ambitious, it clearly signals the government’s intentions, reckon analysts. Around 42% of the projects are already under implementation, so order book execution is likely to show pronounced improvements in the coming year. Some are, therefore, optimistic of a better outcome this time. “The national infrastructure pipeline establishes a baseline trajectory for infra capex in India,” notes Citi, adding that a comprehensive monitoring and bottom-up follow-through should lead to better execution outcomes compared to the past.

Infra stocks have declined in recent years

For many infra companies, persistent bottlenecks have led to project delays.

Data as on 27 Jan. 3-year returns annualised Source: Capitaline

However, many remain sceptical of intent translating into execution. “On ground, not much has improved post the IL&FS debacle. A lot of structural problems need to be addressed before infra firms see sustained earnings momentum,” says Asutosh Mishra, Head of Institutional Research, Ashika Stock Broking. “Within infrastructure and construction in general we have struggled to find good names,” concedes Surana, who prefers to remain with sector leaders.

Many ancillary businesses like cement and building materials are worthy investments too. According to Citi, L&T would be the biggest beneficiary of the improvement in infra capex due to its presence in the entire spectrum of the infrastructure space. Motilal Oswal Securities recommends buy on L&T as a preferred large-cap play, and KNR Constructions and Ashoka Buildcon as key mid-cap plays in the road sector.

3. Small cap valuations now very attractive

New investing guidelines mean that small-cap funds have a wider universe of stocks to choose from.

After the sharp correction in midand small-caps in the past two years, there is renewed interest in these stocks. While the risk-reward is in favour of mid- and small-caps, some experts say small-caps offer a better opportunity now. Small-cap valuations have fallen sharply from the peaks touched in January 2018. The opportunity seems ripe for considering an investment in small-caps, feels Anoop Bhaskar, Head – Equity, IDFC AMC. “Small-cap market capitalisation as a percentage of largecap market capitalisation is currently closer to the levels seen in 2013 bottom and below the 2016 troughs, which can be a signal of a turnaround,” he says.

ICICI Securities analysts also point out that the risk spread has risen sharply for small and micro caps, whereas the risk spread for mid-caps (relative to large-caps) continues to be low. “The sell-off since January 2018 has ensured the significant relative outperformance of small-caps has disappeared while midcaps have held on to some of the outperformance,” the report states.

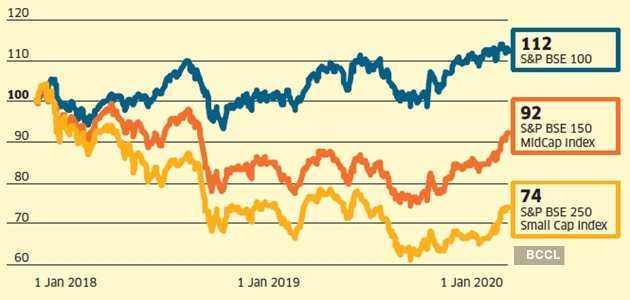

Small-caps have declined in past two years

The small cap index fell 26%, bringing the valuations to attractive levels

Besides, experts insist the revised market cap definitions make small-cap funds a more compelling investment. As per the new rules, mid-cap funds have to direct 65% of the corpus to stocks ranked between 100th and 251st in terms of market capitalisation. This universe is quite restrictive, limiting manoeuvrability for fund managers. On the contrary, small caps can now pick stocks ranked beyond the top 250 in terms of market capitalisation for 65% of the fund corpus. This has opened up a wider, higher quality hunting ground for small-cap funds, as several erstwhile mid-caps now qualify for inclusion in the portfolio.

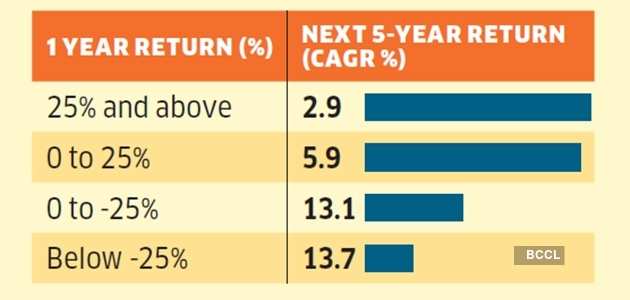

Invest in small-caps when they are down

Data for S&P BSE Small Cap 250 Index considered from Sep’05 to Dec’19. Data as on December 2019. Source: IDFC MF

Investors should, however, tread cautiously. The risk in betting on smaller companies is more pronounced, particularly in the midst of a slowdown. This segment comprises relatively weaker business models with higher mortality rate. “As a caveat, while the opportunity seems thought-provoking, one has to keep in mind the risks of its large drawdowns and wide range of return,” cautions Bhaskar. He believes that normal SIPs of 3 -5 years would come in too late to catch the favourable cycle and hence is not the most optimum way of investing in small-caps now. Investors should instead invest lump sum and STPs of not more than 6-9 months, Bhaskar adds. Also, stick with funds with a proven track record and limit the allocation towards small-caps to 15-20% of the portfolio.

4. Credit risk funds might give good returns

But these funds carry higher risk of default. Investors must go for schemes and fund houses with a good track record.

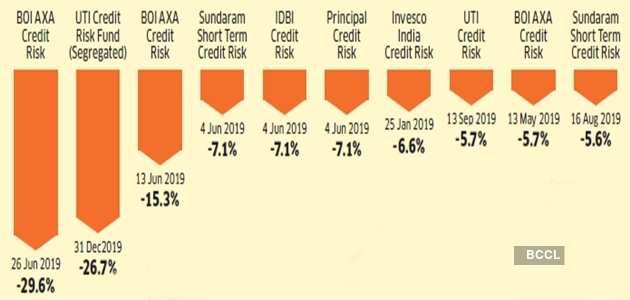

For anyone investing in debt funds, losing 5-7% of the capital in one day is distressing. The gains of one full year are wiped out in a day. Credit risk funds have been hit by defaults and downgrades in the past year (see graphic). Owing to multiple credit events, the credit risk category was the worst performer among all debt funds last year.

These credit risk funds were hit by defaults and downgrades

Some of these were hit by credit events in two or more holdings. The date of the credit event is mentioned below.

Data as on 24 Jan | Source: Ace MF

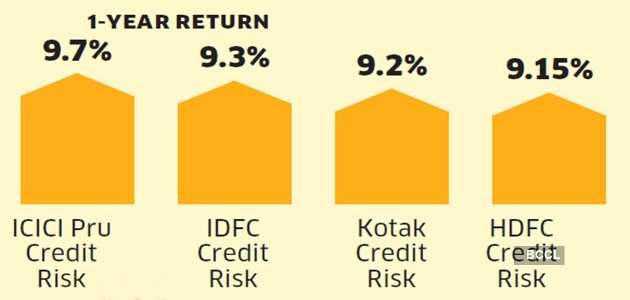

Quality funds gave healthy returns

Only investors with higher risk appetite may consider funds running higher YTM.

Data as on 24 Jan | Source: Value Research

But experts feel this is a good time to consider good quality credit risk funds. The gap between yields of AAA or highest grade corporate bonds and lower rated bonds have widened considerably. “When returns get into negative territory, the actual risk goes down even though perceived risk is higher,” argues Vijai Mantri, Co-Founder and Chief Investment Strategist, JRL Money. Mantri says credit risk funds can give good returns in the coming years.

[“source=economictimes”]