Reliance Capital invited Nippon Life Insurance to acquire up to 42.88 percent stake in Reliance Nippon Life Asset Management (RNAM) as per a release on the stock exchange on February 21. Nippon Life is co-promoter in the asset management company (AMC), with an equal stake of 42.88 percent.

While further developments need to be closely monitored, we try to decipher what this announcement could mean for minority shareholders of the company. In the process, we also highlight the key points which investor needs to know about the company.

RNAM, the first AMC to list, made its debut on bourses in November 2017 around Rs 295 per share, a premium of 17 percent over its issue price of Rs 252.

RNAM’s business profile – healthy trends in AUM growth

RNAM’s assets under management (AUM, excluding pension assets) stood at Rs 2.36 lakh crore as at December-end, making it the fifth largest AMC in the country. The AMC has seen healthy trends in AUM growth.

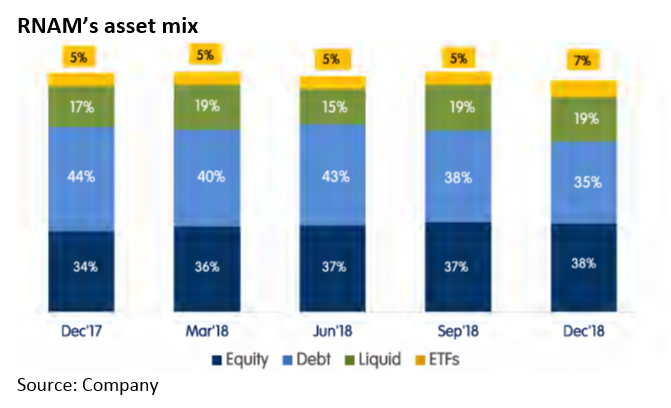

Its equity assets saw an 8 percent year-on year (YoY) growth to Rs 89,794 crore as at December-end. As a consequence, the share of equity assets increased to 38 percent of average quarterly AUM, an improvement of 400 basis points (100 bps=1 percentage point) as compared to the same period last year. As fee on equity assets is much higher compared to other asset classes, the change in asset mix in favour of equity assets indicates the management’s focus on profitable growth.

RNAM is also one of the largest exchange traded fund (ETF) players with around 17 percent market share (in terms of quarterly average AUM). Including ETFs, equity assets stood at Rs 1,02,734 crore as at December-end, rising 12 percent year-on-year (YoY).

It enjoys monthly inflows of Rs 842 crore through systematic investment plan (SIP), which provides better visibility of AUM growth since SIP inflows are generally for the long term and tends to be relatively sticky.

Despite not having a captive bank distribution channel, RNAM is ahead of industry in sourcing assets from beyond top 30 cities, referred as B30 locations. These locations contributed 18 percent of RNAM’s average AUM, better compared to industry’s B30 AUM at 15 percent.

RNAM’s intra-group exposures

The company has extended inter-corporate deposits (ICDs) to companies belonging to its Anil Dhirubhai Ambani Group (ADAG). As of March last year, RNAM had ICDs of Rs 425 crore, around 19 percent of its net worth. Investors need to closely monitor the unwinding of these exposures.

Exit of Reliance ADAG can help abate investor concerns

Despite reporting healthy trends in asset flows, the stock has remained under pressure. The financial problems of the Reliance ADAG Group, of which the company is a part of, has hurt the stock.

Even though Nippon Life is an equal partner with 42.88 percent stake in the AMC, Reliance ADAG’s stake has been a key overhang for the stock. Hence, Reliance ADAG group’s decision to reduce its stake in the business will help assuage investor concerns.

Will the stake sale by Reliance Capital trigger an open offer?

As per the exchange release, Reliance Capital may sell its entire AMC stake (42.88 percent).

It is worth noting that the Securities and Exchange Board of India’s (SEBI) issue of capital and disclosure requirements (ICDR) requires promoters’ contribution to be locked in for three-years following an initial public offer (IPO). Accordingly, Reliance Capital and Nippon’s 10 percent stake each are locked-in for a period of three-years from the date of allotment, which was around August 2017. Hence, it is unlikely that Reliance Capital will fully exit its AMC business.

Even a part exit of Reliance Capital will trigger an open offer to minority equity shareholders, who hold around 14 percent equity in the AMC. SEBI’s Substantial Acquisition of Shares and Takeover (SAST) regulations stipulate making a mandatory open offer in the event of any substantial change in shareholding or change in control of the company.

While the deal will be termed as promoters inter se transfer, regulations say that if a party already holds at least a quarter of the target’s voting rights (in this case Nippon Life holds 42 percent in AMC), a mandatory open offer will be triggered if that party acquires more than five percent of the target’s voting rights in any financial year.

What should investors do?

The stock has rallied more than 30 percent following the announcement. Despite the rally, RNAM’s valuations are reasonable considering its strong retail brand, improving asset mix and well-diversified sourcing platform.

At the current market capitalisation of Rs 12,500 crore, RNAM is trading at 5.3 percent the average MF AUM of Rs 2,36,300 crore as at December-end. Its total AUM is higher around Rs 4,14,400 crore because of pension assets managed. Since the management fees on pension assets is minuscule, we don’t include these assets while valuing the company. The stock is currently trading at 20 times FY20 estimated earnings.

On a relative basis, valuation are very compelling. RNAM’s stock is trading at a discount of more than 40 percent to HDFC AMC’s valuation. The most common push back to this kind of valuation comparison is that HDFC AMC is in a league of its own and commands a premium valuation for its brand and superior return ratio, with a 40 percent return on equity (RoE). While rightful discount to HDFC AMC is justified, RNAM is trading at a significant discount, which we think is unwarranted and should narrow down. Given the reasonable valuations, the stock could further re-rate, if the deal goes through.

[“source=moneycontrol”]