After a gap of six months, mutual funds have renewed their interest in bank shares, with March recording the highest jump in six months in funds allocated to the sector.

The jump is on the back of good growth outlook, profitability and capital ratios, data released on the Securities and Exchange Board of India (SEBI) showed.

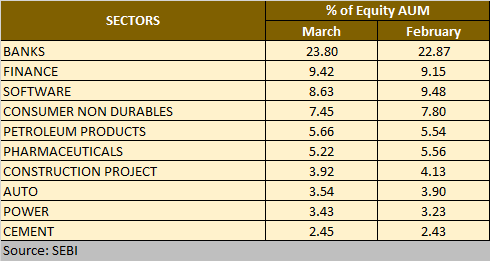

In March, the funds deployed 23.80 percent of their equity assets under management (AUM) into the banking sector, the highest allocation to any sector. The next-best sector fund houses ploughed money into was finance companies.

Since September 2018, fund managers refrained from making major investments into NBFCs like Infrastructure Leasing & Financial Services Ltd (IL&FS) after some of its subsidiaries’ credit ratings were downgraded.

Dewan Housing Finance Corporation’s (DHFL) share price has also been falling since the IL&FS crisis broke out in September.

Also, an online investigative portal alleged that DHFL promoters had lent money to ‘shell companies’ allegedly linked to the promoters who have used this money to buy assets abroad.

In September 2018, the investments in the banking and finance sectors stood at 19.78 percent and 9.18 respectively.

The data released on the website of the SEBI showed that 43 mutual funds had invested Rs 2,61,133 crore in bank stocks in March. The numbers in February were 22.87 percent or 2,28,920 crore, a shade higher than the 22.83 percent in January.

Mutual fund managers attributed the increased allocation of bank shares to good growth outlook and profitability.

Generally, banking is the most preferred sector with fund managers as they cannot take a bearish call on the banking sector, given the sector’s 31 percent weight in the S&P BSE index.

After banks, finance was the second-most preferred sector with fund managers. Equity fund managers’ deployment in finance stocks was at Rs 103,380 crore, followed by software (Rs 94,703 crore), consumer non-durables ( Rs 81,697 crore) and petroleum products (Rs 62,108 crore).

“Select private sector bank and select non-banking finance companies to continue to show good growth outlook, profitability, and capital ratios,” said a fund manager from a private fund house

According to most fund managers, life insurance and general insurance companies offered promising opportunities due to high growth driven by low penetration and increasing financialisation of savings.

Fund houses were upbeat on the IT sector given the increased investments in the front end, UI (user interface) and cloud migration which is driving the demand for companies.

FLOWS, AUM

Data for equity flows into mutual funds for March came as a breather after a weak February. An increase in net inflows in equity and income category led to the overall rise.

Pure equity schemes received strong inflows of Rs 9,014 crore — highest since October 2018 — as against Rs 3,950 crore in February 2019 which came in at a two-year low.

Interestingly, equity AUMs witnessed a staggering growth of 10 percent on a month-on-month basis and stood at Rs 9,76,000 crore, its highest ever growth that was supported by a surge in equity markets when Nifty climbed 7.7 percent in March.

The AUM of the Indian mutual fund industry came in at Rs 23.80 lakh crore in March 2019, up 2.73 percent against Rs. 23.16 lakh crore in February 2019, according to the Association of Mutual Funds in India (AMFI).

[“source=moneycontrol”]