Overview

This guide provides a quick summary of what responsible investment is, the main ways in which it is done and the key forces driving its growth.

It also addresses some common misconceptions about what responsible investment is, and what it entails.

For more information on anything in this guide, or responsible investment more broadly please get in touch.

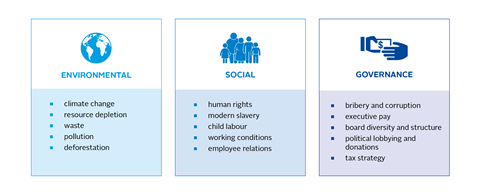

Examples of ESG issues

There are many ways to invest responsibly. Approaches are typically a combination of two overarching areas:

| CONSIDERING ESG ISSUES WHEN BUILDING A PORTFOLIO (known as: ESG incorporation) |

IMPROVING INVESTEES’ ESG PERFORMANCE (known as: active ownership or stewardship) |

|||

|---|---|---|---|---|

| ESG issues can be incorporated into existing investment practices using a combination of three approaches: integration, screening and thematic. | Investors can encourage the companies they are already invested in to improve their ESG risk management or develop more sustainable business practices | |||

| Integration | Screening | Thematic | Engagement | Proxy voting |

| Explicitly and systematically including ESG issues in investment analysis and decisions, to better manage risks and improve returns. | Applying filters to lists of potential investments to rule companies in or out of contention for investment, based on an investor’s preferences, values or ethics | Seeking to combine attractive risk return profiles with an intention to contribute to a specific environmental or social outcome. Includes impact investing. | Discussing ESG issues with companies to improve their handling, including disclosure, of such issues. Can be done individually, or in collaboration with other investors. | Formally expressing approval or disapproval through voting on resolutions and proposing shareholder resolutions on specific ESG issues. |

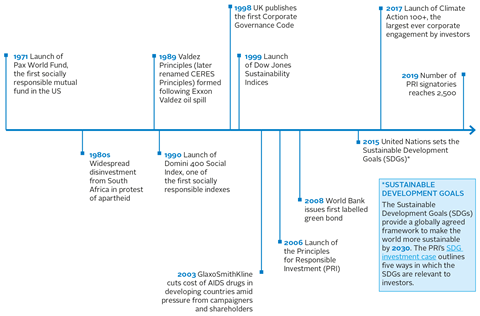

Milestones in the evolution of responsible investment:

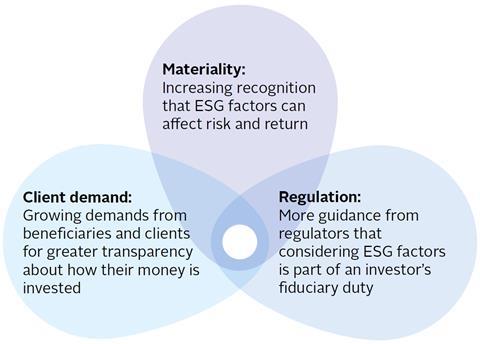

Why invest responsibly?

Several forces are driving the growth of responsible investment:

Materiality

There is a growing recognition in the financial industry and in academia that ESG factors influence investor returns. Explicitly and systematically including ESG issues in investment analysis and decisions – to better manage risks and improve returns – is called ESG integration.

- 2010: The Deepwater Horizon oil spill, for which BP recorded a US$53.8 billion pre-tax charge.

- 2015: Volkswagen is exposed as having rigged 11 million diesel vehicles to pass emissions tests, resulting in costs including €27.4 billion in penalties and fines.

- 2018: Facebook sees billions wiped from its market value after Cambridge Analytica was able to harvest personal data from 87 million users without their consent.

An analysis of over 2,000 academic studies on how ESG factors affect corporate financial performance found “an overwhelming share of positive results,” with just one in 10 showing a negative relationship.

PRI-commissioned research1 indicates that engaging with companies on ESG issues can create value for both investors and companies, by encouraging better ESG risk management and more sustainable business practices.

PRI resources:

- Top academic resources on responsible investment

Client demand

Beneficiaries and clients are increasingly calling for greater transparency about how and where their money is invested. This is driven by growing awareness that ESG factors influence company value, returns and reputation, and by an increasing focus on the environmental and social impacts of the companies they are invested in. Negative screening, which excludes certain sectors, companies or practices, is the most widespread approach to integrating values in a portfolio or fund.

Regulation

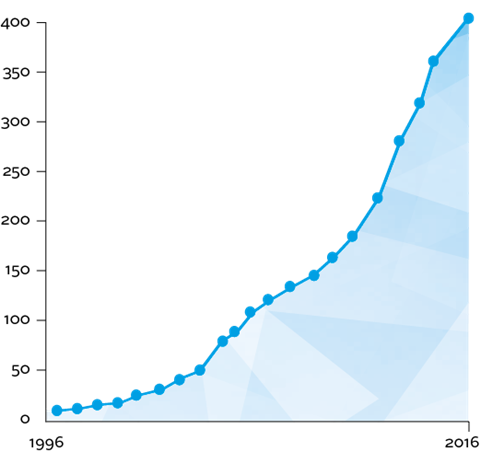

Since the mid-nineties, responsible investment regulation has increased significantly, with a particular surge in policy interventions since the 2008 financial crisis. Regulatory change has also been driven by a realisation among national and international regulators that the financial sector can play an important role in meeting global challenges such as climate change, modern slavery and tax avoidance.

Cumulative number of policy interventions (counting new policies and policy revisions)

Most regulations related to responsible investment can be grouped into three categories, reflecting various parts of the investment chain:

| ASSET OWNERS | STEWARDSHIP | CORPORATE DISCLOSURE |

|---|---|---|

| Asset owner regulations are usually focused on disclosure requirements for pension funds (e.g. as part of a statement of investment principles) or key state-owned asset owners. Prudential regulators are beginning to consider climate risk in the insurance market. | Stewardship codes govern the interactions between investors and investee companies, to encourage better governance, and protect shareholders. | Guidelines, typically from governments or stock exchanges, encourage or require companies to disclose the information on ESG risks and opportunities that investors need. Disclosure can also raise awareness of ESG issues within a company, which can lead to them being managed better. |

Investors’ obligation (in many jurisdictions deemed fiduciary duty) to act in the best interests of beneficiaries has been used by some investors as a reason not to incorporate ESG issues in investment decision making, due to the misconception that ESG factors are not financial factors.

However, work undertaken by the PRI on the topic has clarified that financially material ESG factors must be incorporated into investment decision making, including that:

- Investors should consider ESG factors, consistent with the time frame of the obligation.

- Investors should understand and incorporate the ESG preferences of their clients and/or beneficiaries.

- Investors should consider disclosing the process followed.

PRI resources:

- Fiduciary duty in the 21st century

- Responsible investment regulation map

Misconceptions

The responsible investment industry is evolving rapidly, resulting in misconceptions about what it entails, including:

…it involves investing in a specific investment strategy or product

- Responsible investment does not necessarily require investing in a specific strategy or product. It simply involves including ESG information in investment decision-making and stewardship practices, to ensure that all relevant factors are accounted for when assessing risk and return. Exactly how an investor practices responsible investment varies widely.

…it leads to lower investment returns

- Responsible investment does not require sacrificing returns; it should, in fact, enhance risk and return characteristics. Investors apply a range of techniques to identify risks and opportunities that might remain undiscovered without the analysis of specific ESG data and broad ESG trends.

…it is the same as sustainable, ethical, socially responsible and impact investing

- There are many terms associated with the plethora of investment approaches that consider environmental, social and governance issues. Most lack formal definitions, and they are often used interchangeably. A key to understanding how responsible investment is broader than these concepts is that where many make moral or ethical goals a primary purpose, responsible investment can and should also be pursued by the investor whose sole focus is financial performance.

What role does the PRI play?

The PRI is a global organisation that encourages and supports the uptake of responsible investment practices in the investment industry.

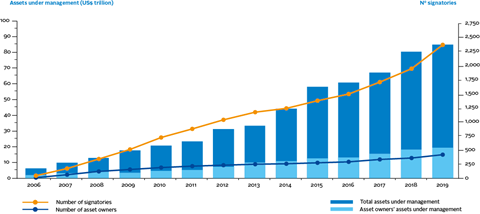

Interest in responsible investment has risen rapidly since the PRI’s launch in 2006, with total PRI signatories now exceeding 2,500, and reaching all around the world.

PRI signatories commit to implement the six Principles for Responsible Investment across their organisation. The PRI helps investors to do this via:

- Resources: Providing guidance and tools on a wide range of topics to help investors further their responsible investment practices.

- Collaborative engagements: Coordinating groups of signatories to engage with companies on high-priority ESG issues.

- Public policy: Engaging policy makers on relevant issues, to create a more sustainable financial system.

- Academic research: Supporting innovative responsible investment research and showcasing research findings for investors.

- Convening investors: Connecting signatories with each other, through events and regional networks, to share knowledge.

- Reporting: The PRI Reporting Framework enables signatories to understand their strengths and areas to improve. Signatories are also confidentially scored and benchmarked against their peers. Signatories can share private reports, and the PRI makes select information public to provide transparency.

- PRI Academy: Training investment professionals through online courses.

-

Tools and platforms: Enabling investors to join forces on the PRI Collaboration Platform, and to explore responsible investment trends and practices on the PRI Data Portal.

[“source=unpri”]